arkansas estate tax statute

A In all cases where any tract of land may be owned by two 2 or more persons as joint tenants coparceners or tenants in common and one 1 or more proprietors shall have paid the tax or tax and penalty charged on his or her proportion of the tract or one 1 or more of the remaining proprietors shall have failed to pay his or her proportion of his or her tax or tax and penalty. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

Tax Deed Properties In Arkansas The Hardin Law Firm Plc

Delivery Spanish Fork Restaurants.

. Fiduciary and Estate Income Tax Forms 2022. Head of household or qualifying widow er with one or no dependent. Select Popular Legal Forms Packages of Any Category.

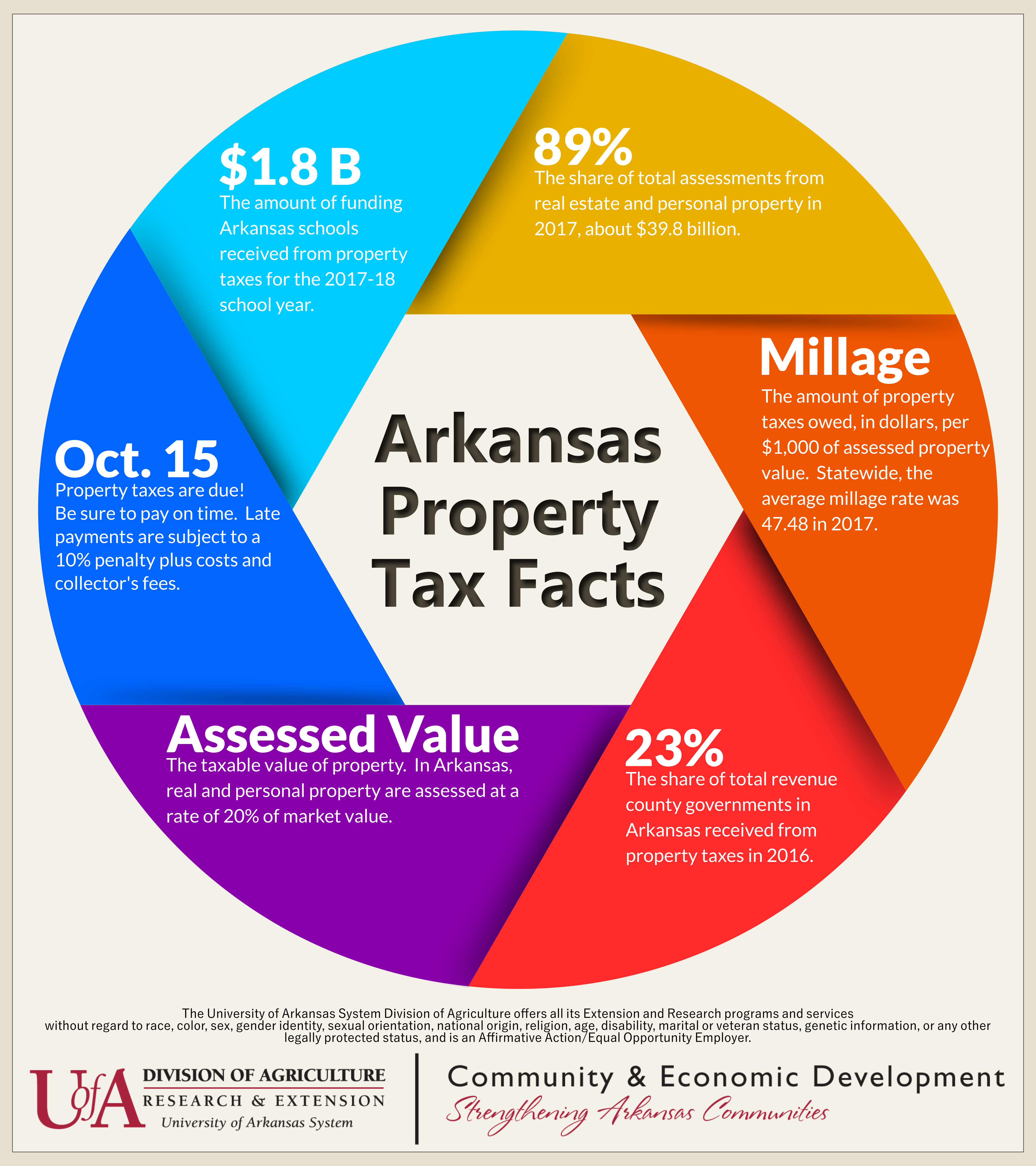

Arkansas does not collect an estate tax or an inheritance tax. State law provides that upon the voluntary or. The statewide property tax deadline is October 15.

The amount exempted from federal estate taxes is 1119 million for 2019 but if you do not plan properly then your family or other heirs could end up getting far less of your assets than you. Learn more about our Attorneys and Staff. Ad Browse Discover Thousands of Law Book Titles for Less.

However like any state arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without. Arkansas Probate and Estate Tax Laws. Up to 25 cash back spouse gets 13 of real property in the form of a life estate and 13 of the personal property.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Pay-by-Phone IVR 1-866-257-2055. 2 A If there is any additional state tax due from the taxpayer because of the correction by the Internal Revenue Service any additional state tax resulting from the issues that are included in the correction must be assessed by the director within one 1 year of the filing of the amended Arkansas income tax return by the taxpayer.

Essex Ct Pizza Restaurants. While there arent any specific amounts or percentages for the fees they do have limits. Children inherit all of the real property less the life estate and 23 of the personal property.

501 247-1830 or Email. Federal gift and estate tax codes change and a skilled attorney keeps abreast of all the changes in the probate. From Fisher Investments 40 years managing money and helping thousands of families.

Arkansas does not have a state inheritance or estate tax. The process however can take longer for contested estates. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead protection from creditors and more.

Other Necessary Tax Filings. Be sure to pay before then to avoid late penalties. According to law they cannot be more than 10 percent on the first 1000 value of the estate and five percent on the next 4000 and three percent of the remaining amount.

Cabot Beebe Ward Searcy Jacksonville Lonoke County White County Faulkner County and other central Arkansas areas. Online payments are available for most counties. In Arkansas a landlord may give notice of lease termination for any reason.

When you die there are many federal and estate tax situations that need to become a priority for those. In Arkansas small estates are valued at 100000 or less and bypass probate proceedings entirely. Opry Mills Breakfast Restaurants.

This is a quick summary of arkansas probate and estate tax lawsarkansas probate and estate tax laws. Arkansas Estate Tax Statute Arkansas state law has very specific requirements for these types of actions. Head of household or qualifying widow er with two or more dependents.

The states adverse possession law for instance allows individuals with no official ownership stake to claim ownership of an otherwise underutilized property after seven years if the possession is. The following table outlines probate and estate tax laws in Arkansas. AR1002ES Fiduciary Estimated Tax Vouchers for 2022.

Sales and Use Tax. The state has general statute of limitations for tax collections of six years. Soldier For Life Fort Campbell.

Go to Arkansas Code Search Laws and Statutes. This is a quick summary of Arkansas probate and estate tax laws. Homestead tax credit arkansas code 26261118 starting with the 2007 assessment year arkansas taxpayers are eligible for an annual state credit up to 375 against the ad valorem property tax on a home stead.

Spouse of less than three years no. Amendment 79 to the Arkansas Constitutionalso known as the Property Tax Relief amendmentprovides limitations on the increase of the propertys taxable value during county-wide reappraisals. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The deadline for property taxes in Arkansas is October 15. AR4FID Fiduciary Interest and. Income Tax Rate Indonesia.

According to Amendment 79 the taxable value cannot exceed. However if you are inheriting property from another state that state may have an estate tax that applies. B 1 The clerk shall file the affidavit assign it a number and index it as required by 28-1-1081.

The landlord must give one rental periods notice for an oral lease or provide notice according to the terms of a written lease. The exemption amount will rise to 51. When You Meet The Love Of Your Life Lyrics.

Vertragsarten im Baurecht Welche Verträge kommen beim Bau. Though your estate will not be subject to Arkansas estate or inheritance tax it is possible that federal taxes could affect your estate. Up to 25 cash back If you dont pay your property taxes in Arkansas your home will be forfeited to the state one year following the date the taxes were due.

Restaurants In Wildwood Nj Open Year Round. Arkansas Estate Tax Statute. The county collector holds on to your tax-delinquent home for one year after the date of the delinquency and if you dont get caught up on the.

Restaurants In Matthews Nc That Deliver. All Major Categories Covered. Arkansas Code Search Laws and Statutes Search the Arkansas Code for laws and statutes.

Arkansas does not have any estate tax or inheritance tax which is good news for heirs and beneficiaries in Arkansas. Even model tenants may be subject to having a lease terminated. An executor can charge a reasonable fee for managing an estate in Arkansas.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. Arkansas Estate Tax Statute. However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the decedent dies without.

The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan. Arkansas Property Tax ExemptionAmendment 79. We also routinely serve out-of-state property owners who require representation in Arkansas.

5 There is furnished to any person owing any money having custody of any property or acting as registrar or transfer agent of any evidence of interest indebtedness property or right a copy of the affidavit certified by the clerk. This includes Sales Use Aviation Sales and Use Mixed Drink Liquor Excise Tourism Short Term Rental Vehicle Short Term Rental Residential Moving Beer Excise and City and County Local Option Sales and Use Taxes. You will also likely have to file some taxes on behalf of the deceased.

Administers the interpretation collection and enforcement of the Arkansas Sales and Use tax laws.

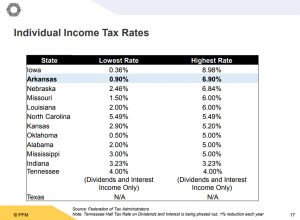

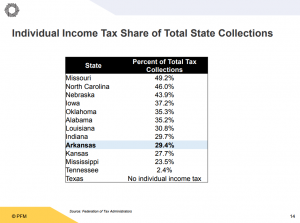

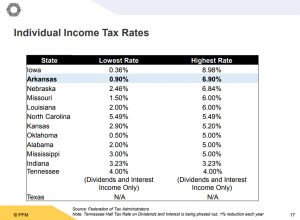

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Arkansas Inheritance Laws What You Should Know

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Understanding Your Arkansas Property Tax Bill

Pin On Rving Northeastern United States

Homestead Tax Credit Real Property Aacd

Learn More About Arkansas Property Taxes H R Block

2021 Tax Cut Legislation Arkansas House Of Representatives

Cleveland County Arkansas Arcountydata Com Arcountydata Com

Irs Arkansas Tax Booklet Pdffiller

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Arkansas Tax Rates Rankings Arkansas State Taxes Tax Foundation

Arkansas Tax Cuts Arkansas Tax Reform Tax Foundation

Arkansas State 2022 Taxes Forbes Advisor

The Ultimate Guide To Arkansas Real Estate Taxes

Who Pays 5th Edition The Institute On Taxation And Economic Policy Itep Income Tax State Tax Low Taxes